All Categories

Featured

Table of Contents

- – High-Performance Accredited Investor Opportuni...

- – Private Equity For Accredited Investors

- – Passive Income For Accredited Investors

- – Accredited Investor Syndication Deals

- – Accredited Investor Passive Income Programs

- – Five-Star Accredited Investor Property Inves...

- – Professional Accredited Investor Crowdfundin...

The guidelines for recognized investors vary among jurisdictions. In the U.S, the interpretation of a recognized capitalist is put forth by the SEC in Rule 501 of Regulation D. To be a certified financier, a person must have an annual income surpassing $200,000 ($300,000 for joint income) for the last 2 years with the expectation of making the very same or a higher revenue in the current year.

A certified financier ought to have a web worth exceeding $1 million, either individually or jointly with a spouse. This amount can not consist of a key residence. The SEC likewise takes into consideration applicants to be accredited investors if they are general companions, executive officers, or directors of a company that is providing non listed safeties.

High-Performance Accredited Investor Opportunities with Maximum Gains

If an entity consists of equity proprietors who are certified capitalists, the entity itself is a recognized financier. Nevertheless, a company can not be developed with the single objective of acquiring certain securities - accredited investor secured investment opportunities. An individual can certify as a recognized capitalist by showing enough education and learning or task experience in the economic sector

People who desire to be recognized investors don't apply to the SEC for the classification. Rather, it is the responsibility of the firm using a private placement to ensure that every one of those approached are accredited financiers. Individuals or celebrations that wish to be certified capitalists can come close to the provider of the unregistered protections.

Suppose there is a specific whose income was $150,000 for the last 3 years. They reported a main residence value of $1 million (with a home loan of $200,000), a car worth $100,000 (with an outstanding lending of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

This person's web worth is exactly $1 million. Since they satisfy the net well worth demand, they certify to be a certified investor.

Private Equity For Accredited Investors

There are a few less typical qualifications, such as handling a depend on with even more than $5 million in possessions. Under government securities legislations, only those who are accredited investors may participate in specific protections offerings. These might include shares in exclusive positionings, structured products, and private equity or bush funds, among others.

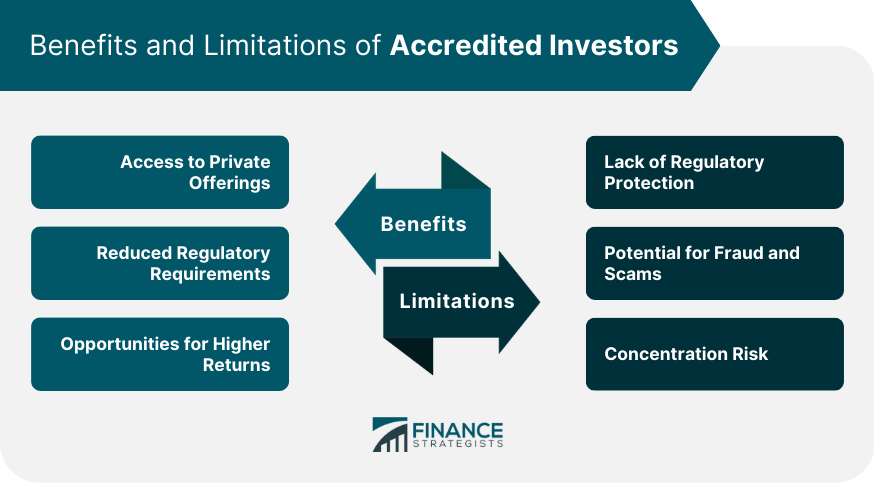

The regulatory authorities wish to be certain that individuals in these highly dangerous and complicated investments can fend for themselves and evaluate the dangers in the absence of federal government defense. The accredited investor regulations are developed to safeguard prospective capitalists with limited monetary knowledge from adventures and losses they may be ill outfitted to endure.

Certified capitalists fulfill qualifications and expert standards to gain access to exclusive investment chances. Certified capitalists must fulfill revenue and net well worth needs, unlike non-accredited individuals, and can spend without limitations.

Passive Income For Accredited Investors

Some key modifications made in 2020 by the SEC include:. This modification recognizes that these entity kinds are frequently utilized for making investments.

This adjustment represent the effects of rising cost of living in time. These changes increase the certified capitalist pool by around 64 million Americans. This larger accessibility supplies much more possibilities for investors, however also enhances potential threats as less monetarily advanced, capitalists can get involved. Organizations using private offerings may gain from a bigger pool of prospective capitalists.

These investment choices are exclusive to recognized financiers and establishments that qualify as a recognized, per SEC regulations. This provides certified investors the chance to invest in emerging companies at a phase before they think about going public.

Accredited Investor Syndication Deals

They are viewed as investments and are easily accessible only, to certified customers. In addition to recognized firms, qualified capitalists can pick to spend in startups and up-and-coming ventures. This uses them tax obligation returns and the opportunity to go into at an earlier stage and potentially enjoy benefits if the company flourishes.

Nevertheless, for financiers available to the threats included, backing startups can cause gains. Many of today's technology firms such as Facebook, Uber and Airbnb came from as early-stage startups sustained by accredited angel financiers. Innovative capitalists have the chance to discover financial investment alternatives that might produce more profits than what public markets offer

Accredited Investor Passive Income Programs

Although returns are not ensured, diversity and profile improvement options are increased for investors. By diversifying their portfolios through these increased investment methods accredited financiers can enhance their methods and potentially attain superior lasting returns with proper threat monitoring. Experienced financiers usually experience investment alternatives that may not be easily available to the basic financier.

Financial investment choices and safeties provided to certified investors generally entail greater threats. For instance, personal equity, equity capital and bush funds often concentrate on purchasing assets that bring threat however can be liquidated easily for the opportunity of higher returns on those risky financial investments. Researching before spending is critical these in scenarios.

Lock up durations avoid investors from taking out funds for more months and years on end. Capitalists may have a hard time to precisely value exclusive assets.

Five-Star Accredited Investor Property Investment Deals

This adjustment may expand accredited financier condition to an array of individuals. Allowing companions in dedicated relationships to integrate their sources for shared qualification as accredited investors.

Making it possible for people with specific specialist qualifications, such as Series 7 or CFA, to qualify as certified capitalists. Creating additional requirements such as evidence of financial literacy or successfully completing a recognized financier test.

On the other hand, it might additionally result in seasoned capitalists assuming extreme dangers that may not be ideal for them. Existing certified financiers might deal with raised competition for the ideal financial investment possibilities if the pool grows.

Professional Accredited Investor Crowdfunding Opportunities

Those that are presently thought about accredited investors need to remain upgraded on any type of changes to the criteria and regulations. Their eligibility could be subject to alterations in the future. To preserve their condition as recognized financiers under a revised meaning adjustments might be necessary in wide range management methods. Services seeking recognized investors ought to stay alert concerning these updates to ensure they are bring in the right audience of financiers.

Table of Contents

- – High-Performance Accredited Investor Opportuni...

- – Private Equity For Accredited Investors

- – Passive Income For Accredited Investors

- – Accredited Investor Syndication Deals

- – Accredited Investor Passive Income Programs

- – Five-Star Accredited Investor Property Inves...

- – Professional Accredited Investor Crowdfundin...

Latest Posts

Tax Properties Foreclosure

Investing In Tax Liens

Tax Liens Investing

More

Latest Posts

Tax Properties Foreclosure

Investing In Tax Liens

Tax Liens Investing